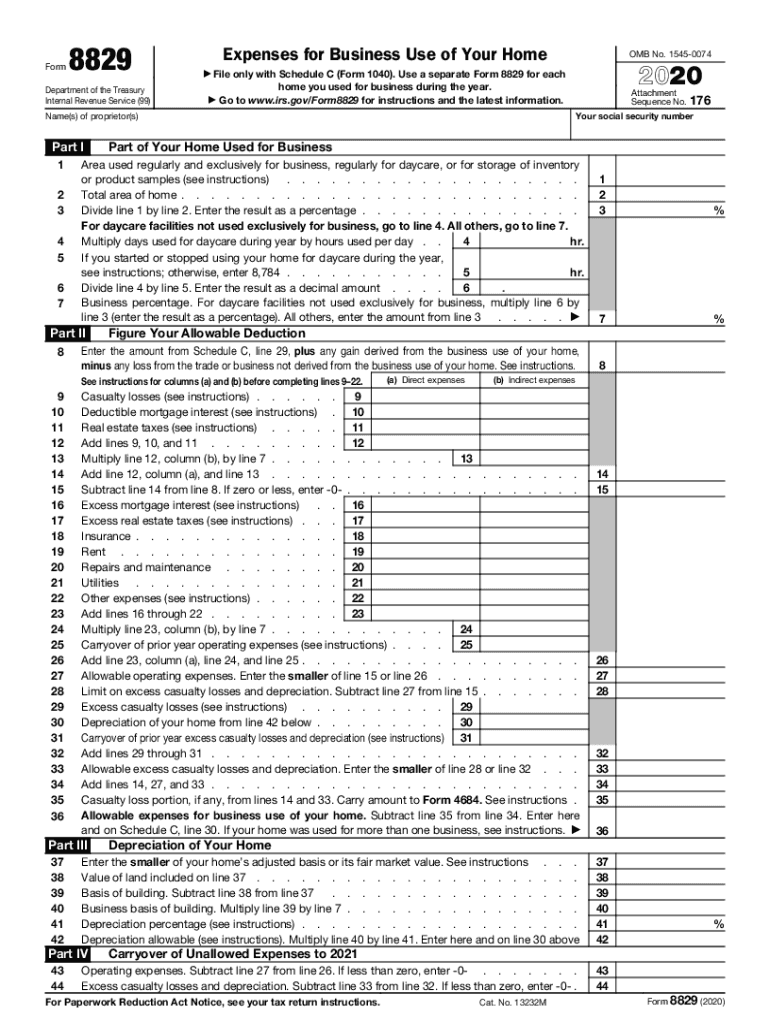

Irs Form Work From Home . irs form 8829 is one of two ways to claim a home office deduction on your business taxes. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. Calculate the part of your home used for business. in this article, we will explain how to fill out irs form 8829 and claim your home office deduction. 4 steps to fill out form 8829. use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. irs form 8829 is used to claim expenses for the business use of your home.

from www.uslegalforms.com

irs form 8829 is used to claim expenses for the business use of your home. irs form 8829 is one of two ways to claim a home office deduction on your business taxes. 4 steps to fill out form 8829. in this article, we will explain how to fill out irs form 8829 and claim your home office deduction. use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. Calculate the part of your home used for business.

IRS 8829 2020 Fill out Tax Template Online US Legal Forms

Irs Form Work From Home irs form 8829 is used to claim expenses for the business use of your home. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. irs form 8829 is used to claim expenses for the business use of your home. in this article, we will explain how to fill out irs form 8829 and claim your home office deduction. Calculate the part of your home used for business. irs form 8829 is one of two ways to claim a home office deduction on your business taxes. use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. 4 steps to fill out form 8829.

From old.sermitsiaq.ag

Letter To Irs Template Word Irs Form Work From Home in this article, we will explain how to fill out irs form 8829 and claim your home office deduction. use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. irs form 8829 is one of two ways to claim a home office deduction on your business. Irs Form Work From Home.

From printablew9.com

Current W 9 Form Irs Printable W9 Form 2023 (Updated Version) Irs Form Work From Home irs form 8829 is one of two ways to claim a home office deduction on your business taxes. in this article, we will explain how to fill out irs form 8829 and claim your home office deduction. the home office deduction is a tax deduction available to you if you are a business owner and use part. Irs Form Work From Home.

From samchurchill.pages.dev

2025 2025 Tax Form Instructions Sam Churchill Irs Form Work From Home use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. in this article, we will explain how to fill out irs form 8829 and claim your home office deduction. irs form 8829 is used to claim expenses for the business use of your home. irs. Irs Form Work From Home.

From worksheets.clipart-library.com

Irs Forms And Worksheets For Homeowners FasterCapital Worksheets Irs Form Work From Home in this article, we will explain how to fill out irs form 8829 and claim your home office deduction. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. irs form 8829 is one of two ways to claim a home. Irs Form Work From Home.

From cheryeqnorean.pages.dev

Mileage 2024 Irs Rates Windy Kakalina Irs Form Work From Home the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. in this article, we will explain how to fill out irs form 8829 and claim your home office deduction. irs form 8829 is used to claim expenses for the business use. Irs Form Work From Home.

From www.uslegalforms.com

IRS 2290 2014 Fill out Tax Template Online US Legal Forms Irs Form Work From Home use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. 4 steps to fill out form 8829. in this article, we will explain how to fill out irs form 8829 and claim your home office deduction. irs form 8829 is used to claim expenses for. Irs Form Work From Home.

From www.formsbank.com

Instructions For Form 1120H U.s. Tax Return For Homeowners Irs Form Work From Home the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. irs form 8829 is one of two ways to claim a home office deduction on your business taxes. 4 steps to fill out form 8829. in this article, we will. Irs Form Work From Home.

From www.templateroller.com

Download Instructions for IRS Form 1120H U.S. Tax Return for Irs Form Work From Home use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. irs form 8829 is used to claim expenses for the business use of your home. irs form 8829 is one of two ways to claim a home office deduction on your business taxes. 4 steps. Irs Form Work From Home.

From kelsibarabele.pages.dev

Irs Form 2024 Es 2024 Alfi Lottie Irs Form Work From Home Calculate the part of your home used for business. use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. in this article, we will explain how to fill out irs form 8829 and claim your home office deduction. irs form 8829 is one of two ways. Irs Form Work From Home.

From www.templateroller.com

Download Instructions for IRS Form 1120H U.S. Tax Return for Irs Form Work From Home in this article, we will explain how to fill out irs form 8829 and claim your home office deduction. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. use form 8829 to figure the allowable expenses for business use of. Irs Form Work From Home.

From www.uslegalforms.com

IRS Instruction 1040 Line 20a & 20b 2014 Fill out Tax Template Online Irs Form Work From Home the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. 4 steps to fill out form 8829. in this. Irs Form Work From Home.

From martinlindelof.com

Irs Dependent Support Worksheet Martin Lindelof Irs Form Work From Home 4 steps to fill out form 8829. irs form 8829 is one of two ways to claim a home office deduction on your business taxes. irs form 8829 is used to claim expenses for the business use of your home. in this article, we will explain how to fill out irs form 8829 and claim your. Irs Form Work From Home.

From www.vrogue.co

Irs Form W 9 Fillable Form Printable Forms Free Online Vrogue Irs Form Work From Home 4 steps to fill out form 8829. Calculate the part of your home used for business. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. irs form 8829 is one of two ways to claim a home office deduction on. Irs Form Work From Home.

From www.uslegalforms.com

IRS Standard Deduction Worksheet for Dependents Line 40 Fill out Irs Form Work From Home Calculate the part of your home used for business. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. irs form 8829 is one of two ways to claim a home office deduction on your business taxes. use form 8829 to. Irs Form Work From Home.

From corybnatividad.pages.dev

2024 W 9 Printable Siana Angelica Irs Form Work From Home 4 steps to fill out form 8829. use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. irs form 8829 is used to claim expenses for the business use of your home. the home office deduction is a tax deduction available to you if you. Irs Form Work From Home.

From form-1120-w.pdffiller.com

2021 Form IRS 1120W Fill Online, Printable, Fillable, Blank pdfFiller Irs Form Work From Home Calculate the part of your home used for business. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. 4 steps to fill out form 8829. in this article, we will explain how to fill out irs form 8829 and claim. Irs Form Work From Home.

From www.templateroller.com

Download Instructions for IRS Form 1120H U.S. Tax Return for Irs Form Work From Home use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. Calculate the part of your home used for business. irs form 8829 is used to claim expenses for the business use of your home. irs form 8829 is one of two ways to claim a home. Irs Form Work From Home.

From www.pdffiller.com

Fillable Online IRS Tax Return Forms and Schedule For Tax Year 2022 Irs Form Work From Home irs form 8829 is one of two ways to claim a home office deduction on your business taxes. use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any. irs form 8829 is used to claim expenses for the business use of your home. 4 steps. Irs Form Work From Home.